Confidence & Certainty

Consistent measurement

Works with existing tools

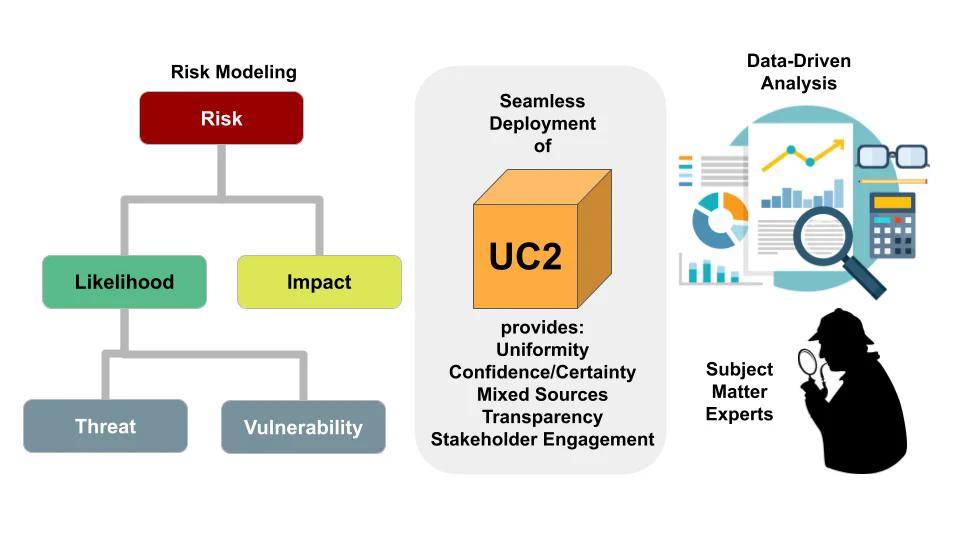

What Is UC2?

Uniform Confidence/Certainty Estimation (UC2) is a structured method for measuring and expressing how trustworthy a risk estimate is — not just what the estimate says.

Confidence

How close an estimate is likely to be to the actual truth.

Certainty

How consistently multiple estimates agree with each other.

UC2 provides a uniform, consistent scale for both quantitative and qualitative risk inputs, whether they come from hard data, expert judgment, or both. This makes it easier to combine different types of estimates without distortion.

Why UC2 Matters in Risk Management

In most risk processes, analysts face two big challenges:

Challenge #1

Subjectivity and inconsistency in expert estimates

Challenge #2

Difficulty combining data-driven results with expert judgment reliably

Traditional risk scales and matrices often fail to express how much you should trust an estimate, leading to overconfidence, miscommunication, and poorly supported decisions. UC2 fixes this by explicitly capturing both the quality and agreement of risk estimates.

Greater Transparency

Everyone understands not just the risk value but how reliable it is

Improved Uniformity

Numeric and expert-based inputs can be compared on the same terms

Better Engagement

Outputs are clearer and easier to discuss with stakeholders

Who Benefits from UC2?

Risk Analysts and Modelers

Who need consistent inputs into risk equations and models.

Decision-Makers & Stakeholders

Who want clarity about the reliability of risk insights.

Cross-Functional Teams

Combining data analysts, subject matter experts, and leadership.

High-Stakes Organizations

Managing cybersecurity, infrastructure, finance, and operations risk.

Practical Use Cases

1. Blending Data and Expert Judgment

Suppose your risk model uses both historical incident data and expert estimates about future threats. UC2 provides a standardized way to express how confident the experts are and how much the data agrees with them, making combined outputs more defensible and actionable.

2. Improving Risk Workshops

In facilitated risk sessions, participants often provide qualitative judgments like "likely," "unlikely," or "high impact." UC2 lets you place those judgments on a consistent confidence scale, improving group understanding and reducing ambiguity.

3. Integrating with Existing Tools

UC2 can feed directly into existing risk models without replacing them. Its outputs are compatible with common risk quantification formats — such as probability distributions, PERT estimates, or expert scorecards — making adoption incremental and low-disruption.

UC2 for CVSS Presentation

Watch this presentation to see how UC2 enhances vulnerability scoring

UC2 Tools & Applications

UC2 Risk Ruler

Simplify and enhance risk estimation by integrating both quantitative and qualitative assessments from subject matter experts.

Learn MoreCVSS Visualization

Visualize Precision, Maturity, and Confidence in the Common Vulnerability Scoring System to better communicate cybersecurity risk.

Learn MoreIn Summary

UC2 is a practical, intuitive, and compatible approach for strengthening risk estimation by making confidence and certainty explicit.

Combine different sources of risk estimates coherently

Communicate the trustworthiness of estimates

Support better, more transparent risk decisions

By integrating UC2 into your risk workflow, you improve clarity, consistency, and confidence in your risk outcomes — without ripping and replacing your existing models.

Want to Learn More?

Contact us to discuss how UC2 can improve your organization's risk management capabilities.

UC2 transforms how organizations understand and communicate risk — making uncertainty explicit, measurable, and actionable.